ISSUE 29: SKYFALL

Is it the plot to the next 007 movie, or just the details of the CCC's investigation into Curaleaf? Plus, Is the sky falling in MSO world?

Welcome to the 29th edition of Burn After Reading! This is my newsletter on cannabis (and other things). You can check out last week’s issue here, and if you haven’t subscribed yet, please do.

Greetings, comrades. It’s currently 9:30AM here in Worcester, and 5:30PM in Moscow. Let’s get right into it.

A RUSSIAN BILLIONAIRE. A SECRET RESEARCH LABORATORY. A HIDDEN RADIATION MACHINE.

These may sound like the plot points of a future James Bond movie, but they’re actually the key details of a state inquiry into Curaleaf — one of the largest cannabis companies in the world.

In last week’s issue, I speculated about whether or not state investigators would be looking into Curaleaf’s alleged dealings with Russian oligarch Roman Abramovich.

This week, we found out that Curaleaf’s alleged ties to Russia aren’t the only thing that regulators are looking into. In addition to the potential secret loans, the Commission is also examining claims that the company ran an unlicensed research facility in Newton, Massachusetts and secretly used a Radsource machine to irradiate contaminated weed.

Multiple sources have already independently confirmed some of the story’s details to me. I’ve reached out to both Curaleaf and their CEO Boris Jordan for comment, and I’ll provide updates if I hear back from them (although I’m not keeping my hopes up).

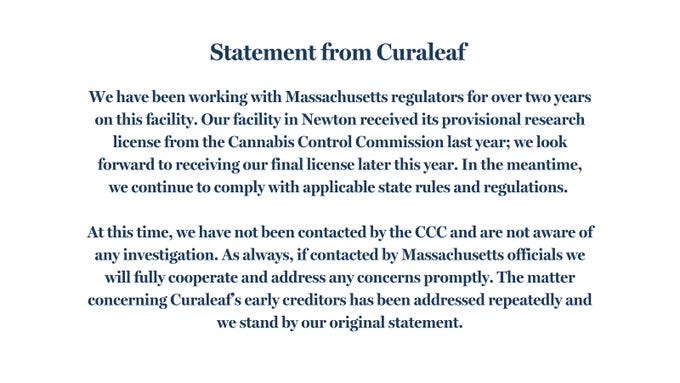

Update (11:20AM): Much to my suprise, Curaleaf has released a statement regarding the situation in Massachusetts.

This is not the company’s first run-in with the Commission investigation department. Back in 2019, the CCC hit the company with a $250,000 fine for failing to get proper approval before a change of ownership.

Beyond their alleged links to the Kremlin, their past transgressions with the CCC, and the other new accusations leveled this week, the company is no stranger to scandals. They’ve been involved in a wrongful death lawsuit, have allegedly sold vapes with high levels of lead, and have been subject to fines by OSHA…..and that’s all just stuff I can remember off the top of my head.

Congrats to Grant for breaking this story. Hopefully mainstream publications quickly realize the massive implications of it.

MULTI-STATE OPERATORS ARE CLOSING STORES AND MISSING RENT

The canaries in the MSO coal mines are dropping dead at an alarming rate this week.

Colombia Care announced on Thursday that it’s closing four retail stores and laying off 25% of its corporate workforce. In a statement entitled “Columbia Care Implements Efficiency Initiatives to Enhance Profitability,” CEO Nicholas Vita (the 3rd highest paid CEO in the industry in 2020) put part of the blame on the illicit cannabis market.

“As Columbia Care continues to grow and evolve, we constantly reassess our operations to objectively determine whether changes are required to drive the business forward. In light of unprecedented inflation and persistent economic headwinds, the current dislocation in the capital markets, and the political and regulatory structures that allow the illicit market to proliferate in some jurisdictions, we have made the decision to restructure targeted areas of our business.”

You see what you did, local weed dealer? You forced this corporate executive to lay off a bunch of his employees! Have you no decency?

(Vita can try to hide behind blaming the regulators, but we know his company’s true feelings about the legacy market.)

Anyways, as Colombia Care continues to “grow and evolve” by shrinking, there’s increasing concern that their proposed merger with Cresco Labs is in danger. The merger was originally supposed to close in December, but that deadline has now been extended to March. Some experts said that completing this deal as quickly as possible was going to be a key component to its success.

If the merger was to fall through, it may also put Diddy’s deal in doubt.

Colombia Care is not the only MSO that is struggling right now; a recent disclosure by a non-plant touching company also gave us some unique insight into space.

IIPR

Innovative Industrial Properties (IIPR) is a real estate company that specializes in sale/leaseback deals with cannabis companies.

Basically, IIPR purchases the company's cultivation facilities, and then leases them back to the original owner. This allows big cannabusinesses to essentially receive a loan from IIPR, while using the building as collateral.

It’s a unique (and incredibly useful) way for large cannabis companies to raise funds in a time where access to traditional financial capital remains limited.

Multi-state operators (MSOs) represent 85% of IIPR's operating portfolio, according to Green Market Report. Their business model relies on the value of the property, so they mainly only do deals that involve large cultivation buildings.

There’s just one issue with this business model: IIPR’s tenants are increasingly failing to pay rent.

While a “cannabis crunch” is clearly upon us, so far it seems like only the biggest names in the industry are truly feeling the squeeze. Perhaps if they had kept their ambitions a bit smaller (and not relied on the idea of federal cannabis legislation passing in 2022), they wouldn’t find themselves in this position.

If you were recently laid off by an MSO, please reach out. I’ll do my best to find you a nice landing spot at a smaller company.

MINIONS AND THEIR BLOGS

Grant Smith Ellis also reported this week that Cannabis Control Commission Chair Shannon O’Brien apparently made an off-hand comment about “minions and their blogs” during her closed door meeting with cannabis industry stakeholders.

Considering both Grant and I asked her questions about her controversial appointment just days before this meeting, it seems fairly likely that the comment was at least partially aimed in my direction.

After all, there’s only a few of us blogging about this stuff.

It would be pretty Despicable (of) Me to get into a war of weasel words with Chair O’Brien, so I’ll just say this: Use the code “MINIONS” to get 15% off a paid subscription to Burn After Reading.

AWARD SEASON

Burn After Reading has been nominated for “Best News/Information source” at the 2023 New England Cannabis Community Awards. This humble little publication is less than a year old, so it’s really cool to be listed alongside these other big names. You can cast your ballot here.

THE WORLD’S TOP CANNABIS HEADLINES

New England

National / Rest of U.S.

Making (more) Room for Cannabis Companies (that exploit us) (Jay Lassiter | NJ Insider)

Second legal, recreational weed store slated for Manhattan (Catalina Gonella | Gothamist)

Why Carnival and Royal Caribbean Outlaw [Cannabis] | (Daniel Kline | The Street)

International

🇬🇧 Heathrow beefs up security after rise in US cannabis smuggling arrests (Sam Cabral | BBC)

🇹🇭 Cannabis Bill second reading House meeting collapses again on Wednesday (Thai PBS World)

WELCOME DISTRACTION

Have you heard of Medieval Music’s “bardcore” remixes of hip hop beats?

Well, you have now.

CAT OF THE WEEK

This cat, who is simply amazed by the concept of a straw.

SPECIAL BULLETINS

If you’re in the Boston-area tonight, be sure to check out Big Hope Project’s event: Backwards Never: Representation, Justice, and Equity for Cannabis Workers

Congrats to ZypRun as they officially open for business. The Boston-based social equity delivery company is now taking orders.

That’s a wrap on this issue. Thanks for reading! If you have any suggestions or feedback, email me here. Be sure to subscribe if you haven’t already, and if you would like to support my work, please consider a paid subscription.