ISSUE 31: NEW DATA FROM MASSACHUSETTS

Plus: I say good riddance to Flow Cana, talk about the situation with discounts in MA, and cover this week's big headlines.

Welcome to the 31th edition of Burn After Reading! This is my newsletter on cannabis (and other things). You can check out last week’s issue here, and if you haven’t subscribed yet, please do.

It’s another jam packed issue, so let’s get right into it!

NEW MARKET DATA FROM MASSACHUSETTS

I dove into the CCC’s recent data release and created some graphs that highlight a few interesting changes we saw to the market last year.

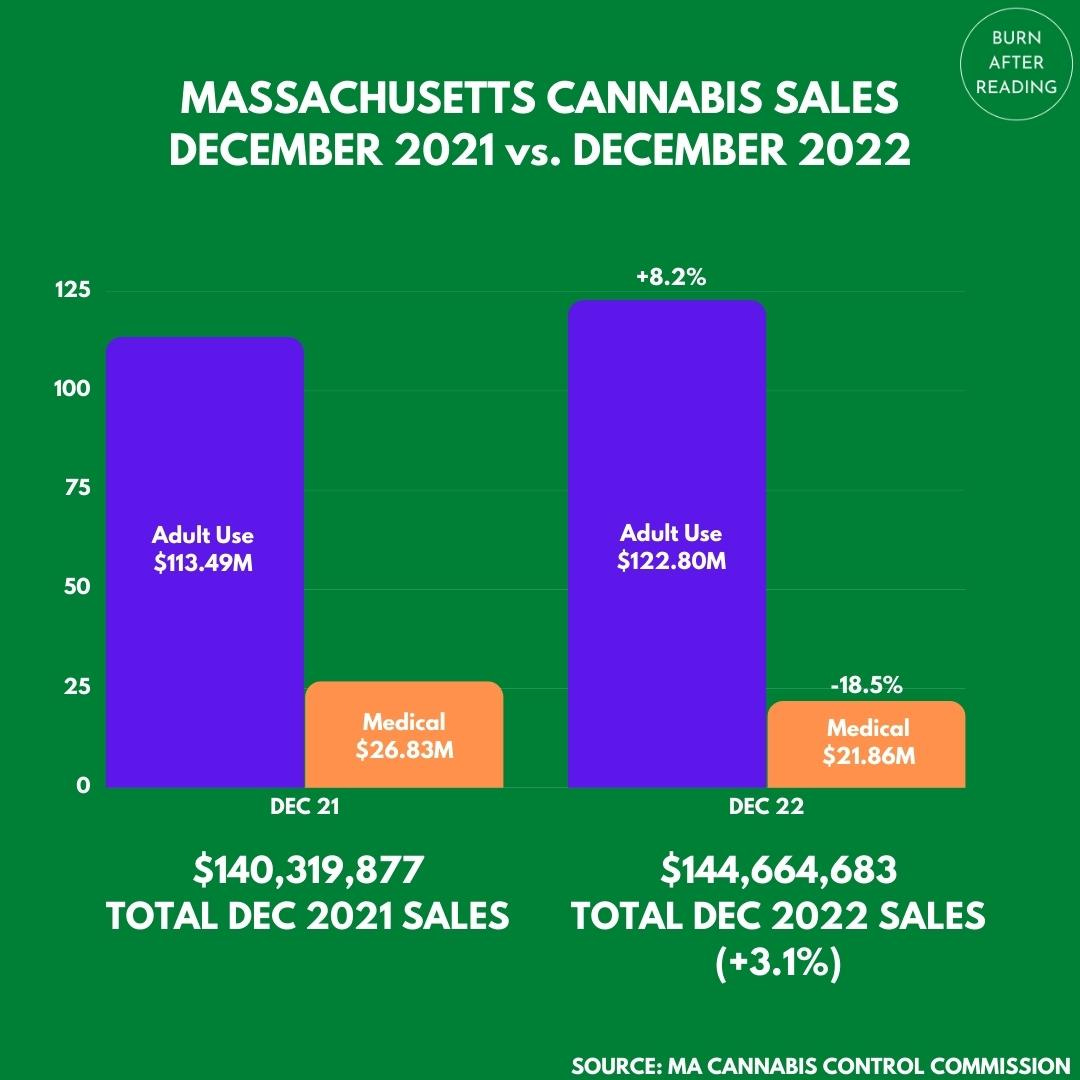

OVERALL SALES ARE UP, BUT MEDICAL SALES ARE DOWN

Overall cannabis sales rose 3.1%, but medical sales declined 18.5%. This may explain why some companies are trying to close their medical-only locations, but what does this mean for patient access? Anybody with a card knows how much easier it is to be in-and-out quickly at a med-only shop, so hopefully those don’t go the way of the dodo bird.

THE DEATH OF FLOWER HAS BEEN EXAGGERATED

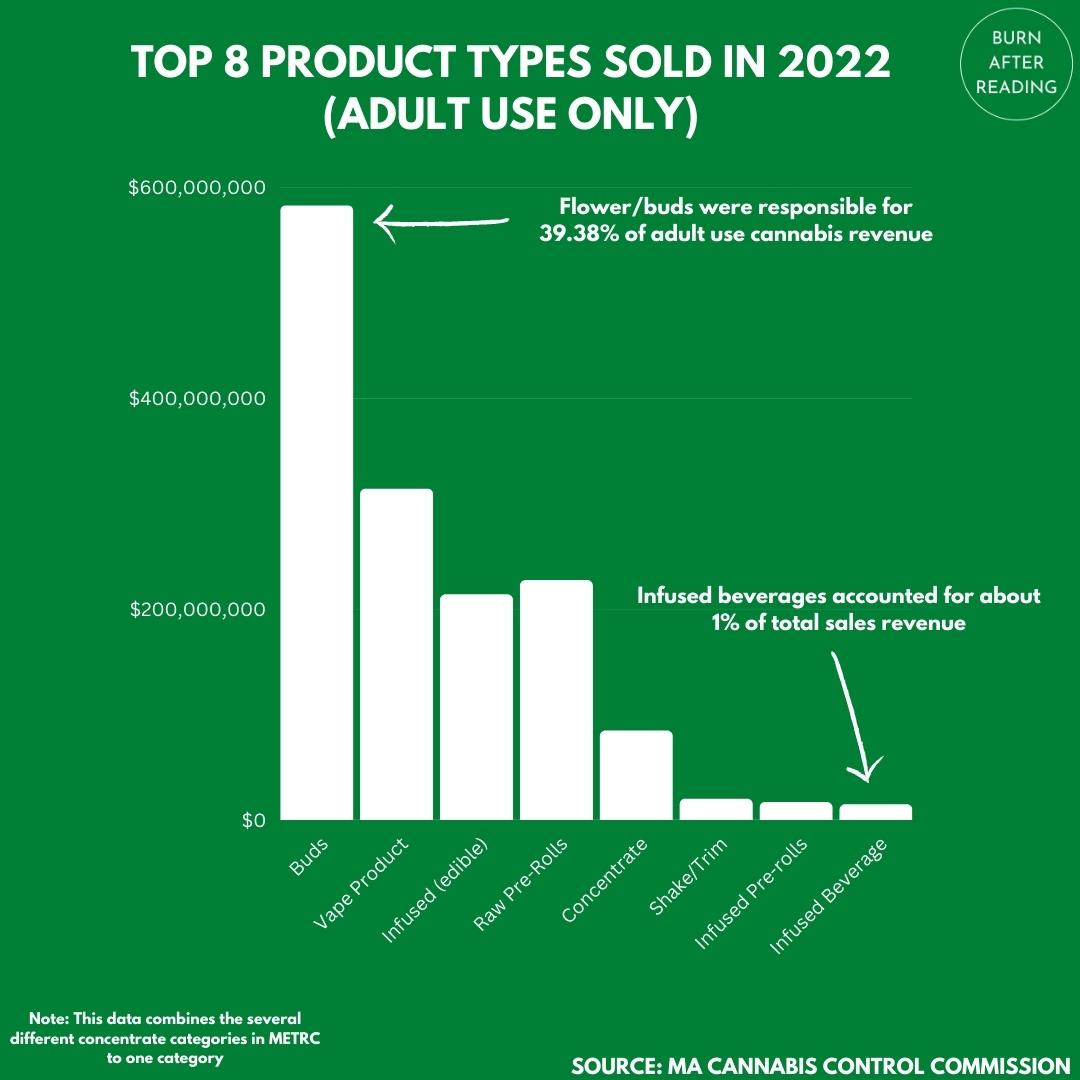

Despite the best wishes of some MSO canna-executives — who would prefer to make products that don’t require intricate weed growing skills — flower remains the undeniable queen of the Bay State marketplace.

Recreational retailers sold more than $583M of flower last year. For some perspective, that’s more revenue than the entire GDP of Tonga.

Vape products ($314M) remained in second place, the same position they claimed in 2021. Pre-rolls ($227.2M) leapfrogged over edibles (213.8M) to take 2022’s bronze medal.

Beverages may be in 8th place, but they still brought in $14.6M from adult use sales.

When you consider theentiremedical program only brought in $21.86M in total sales, this seems slightly more impressive.[Note: In the original version of this post, I mistakenly compared total beverage sales to December’s total medical sales totals.]

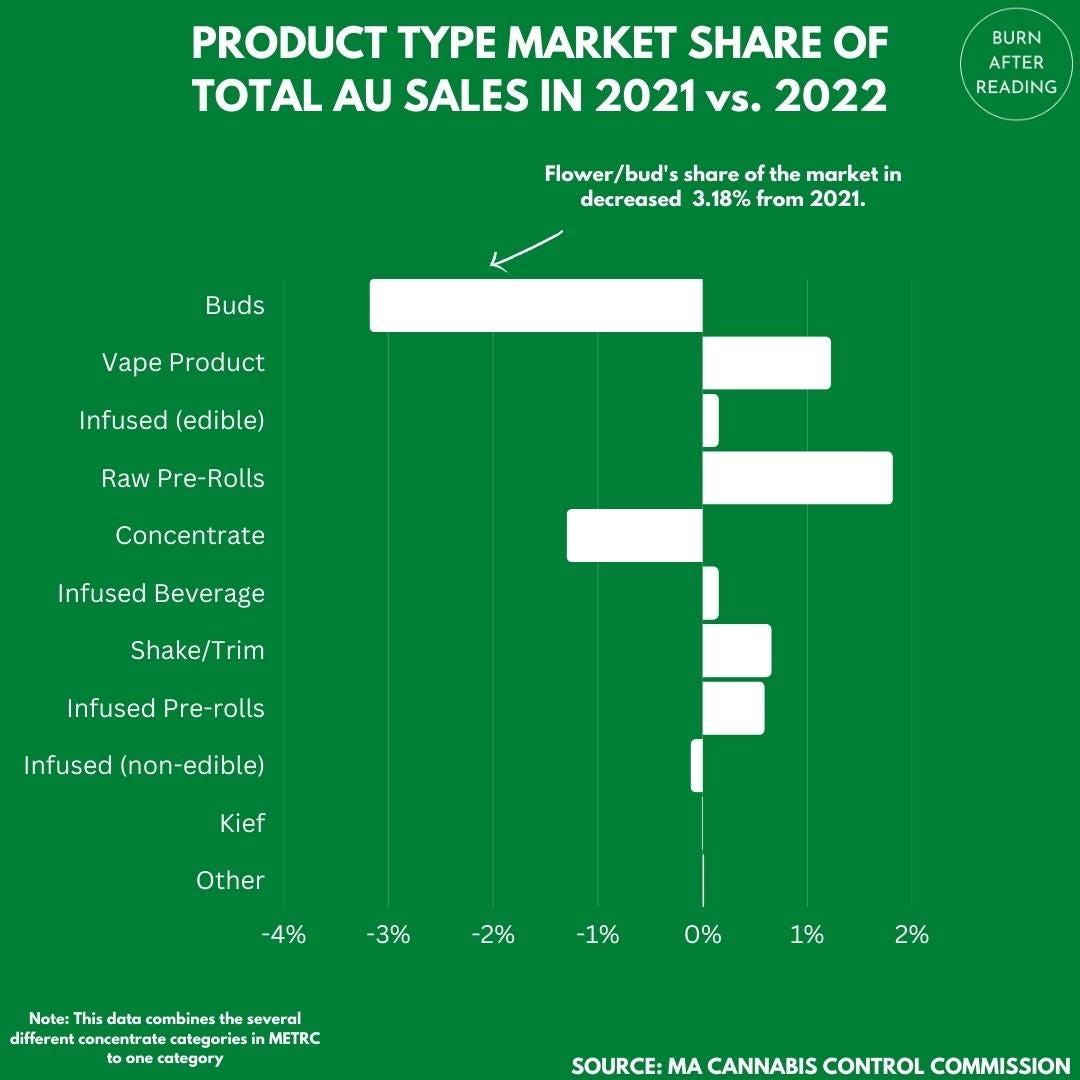

FLOWER LOST SOME GROUND IN 2022, BUT DID IT REALLY?

Flower’s share of the market decreased 3.18% in 2022 – a larger decrease than any other product type. However, you’ll notice a lot of flower-adjacent products like pre-rolls and shake saw a lot of growth.

I was surprised by the disappointingly small gains made by edibles and drinks. My extremely back-of-the-napkin math suggests that — at the current rate — Boris Jordan’s prediction that cannabis drinks will be half the market won’t come true in Massachusetts until sometime around the year 2362. I’m not trying to be a hater (I actually like cannabis drinks!), so I’m interested in seeing how these numbers change in 2023. The majority of consumers I speak to seem turned off by the five milligram limit that the state imposes on beverages, although if drinks were cheaper I think people would complain about this less.

It’s also worth asking: Are all these changes a result of new consumer trends, or just a “return to normal” that was brought about by a shift in behavior after COVID precautions were largely lifted? It could be that vapes and pre-rolls are up because people are out and about at a rate similar to pre-covid levels.

FLOW KANA FAILS IN BUSINESS AND ETHICS

I remember being pretty excited about Flow Cannabis Company (aka Flow Kana) the first time I heard about their business model years ago. The company was proclaiming that it was going to provide small cannabis farmers in California with a clear pathway to wider legal markets, offering the masses an alternative to corporate-grown weed.

Now, the company has been “mothballed” in a desperate hope that an MSO will someday purchase their assets. After hearing details about how they conducted business, I’d be fine with this company going under.

Reporting by Chris Roberts for MJBiz makes it clear that the company’s executives saw small farmers as assets to be managed rather than true partners. The article also alleges a pattern of behavior that suggests the company showed little respect to workers too.

Board Member Kevin Albert’s comments in the article seem flippant and display a stunning lack of self-awareness. At one point, he seems to suggest that workers were only complaining about working conditions and rampid mold in Flow Cana’s facilities because they were concerned they were about to be laid off. He ultimately said the company failed not due to its own transgressions, but because people didn’t actually want to buy organically grown craft cannabis.

From MJBiz:

But, according to Albert, the explanation for Flow Cannabis’ dramatic fall can be reduced to a harsh market reality:

Too few California cannabis consumers wanted to buy sun-grown marijuana marketed based on its responsible, socially conscious ethos, preferring instead for a high-THC, low-dollar proposition.

“People don’t seem to care, honestly,” he said.

“It sounded good, but in the real world, nobody cared.”

Okay, sure.

Sadly, Flow Kana is hardly the only California-based company who has been accused of some serious worker abuse. While cannabis worker safety and rights are clearly a nationwide issue, it seems that things are particularly dire out west.

DISCOUNTS: THE ELEPHANT IN THE MASSACHUSETTS CANNABIS ROOM

Massachusetts lost another dispensary this week, as Pleasantrees in Easthampton announced that January 31st was that location’s last day in business. The small Michigan-based multi-state operator couldn’t cut it in Easthampton’s crowded cannabis market.

Their Amherst location remains open for now, despite reports from Commonwealth Magazine that the company is literally trying to give the store away.

In fact, former Easthampton customers who head to the Amherst shop can get 20% off their purchase.

This raises an important question, though: Aren’t discounts supposed to be against the rules for adult-use cannabis in Massachusetts?

Let’s take a look at the regs:

The following Advertising activities are prohibited:

…

Advertising through the marketing of free promotional items including, but not limited to, gifts, giveaways, discounts, points-based reward systems, customer loyalty programs, coupons, and "free" or "donated" Marijuana, except as otherwise permitted by 935 CMR 500.105(4)(a)9* and except for the provision of Brand Name take-away bags by a Marijuana Establishment for the benefit of customers after a retail purchase is completed.

*= This is the regulation that allows for companies to give discounts/free products to employees.

Pleasantrees is hardly the only company I’ve seen who seems to be skirting this rule. Whether they call them “temporary price discounts” or some other nonsense, there are plenty of companies in Massachusetts who are apparently ignoring this regulation.

I know that I risk sounding like the kid who reminds the teacher that they forgot to assign the class homework right as the bell rings, but it seems like someone had to point this out eventually.

Discounts may seem consumer-friendly, but often they’re used to make it seem like you’re getting a better bargain than you actually are. If deals were truly forbidden, we’d probably just see lower sticker prices as a result (and of course, consumers could get a medical card if they still want access to discounts and loyalty points). Not to mention the fact that discounts are often used to off-load products that are nearing their expiration date.

Maybe I’m somehow reading this regulation wrong — it is a bit confusing to refer to discounts as “free promotional items” after all — but why have a rule if it’s seemingly going unenforced?

I’ll stop being a cop now.

AYR WELLNESS LAYOFFS

I’ve gotten word that Ayr Wellness is in the process of laying off a number of workers across the country. I’ve reached out to the company for comment. I’ve also reached out to the UFCW, who represents some workers at Ayr’s Milford, MA facilities.

I’ll update this space if we get a statement from either organization, or if we get some updated figures on the total number of workers who have been impacted.

Update (2/6): Ayr Wellness has confirmed that 180 employees were laid off.

HEADLINES

(I decided to start to add some blurbs for each headline. Let me know if you like it.)

New England

STARTUP CANNABIS: EOS FARMS GROWS OUTDOORS IN THE NORTHEAST, ENDURES COMMODITY PRICING AND STILL WINS (Aron Kressner | Forbes): “There were a lot of skeptics when it came to growing outdoors in Massachusetts. In fact, the first year’s crop came up short. So when they pulled a full bounty of plants with big, beautiful buds out of the ground this past fall, it did not go unnoticed by the industry.”

WITH CANNABIS FOR SALE, CONNECTICUT [SOCIAL EQUITY] COUNCIL PROPOSES HOW TO STAY FUNDED WITH TAXES (Joseph D'Alessandro | WSHU): “The proposal would feed the THC tax revenue in new social programs, but the council does not yet have a concrete plan to continue funding its own operations. In addition, some of its members were concerned that the budget proposal would not reinvest in the community.“

ADVOCATES HAIL COURT'S 'CRUCIAL FIRST STEP' IN CLEARING ELIGIBLE MARIJUANA RECORDS ( Katie Mulvaney | Providence Journal): “Rhode Island Supreme Court Chief Justice Paul A. Suttell on Friday unveiled the court rules for potentially thousands of Rhode Islanders to clear their records of past marijuana charges, given the state’s recent move to legalize the use and sale of recreational cannabis.”

National / Rest of U.S.

FIRST CANNABIS STORE WITH A BAR AND A BAKERY UNDER THE SAME ROOF OPENS IN ILLINOIS (Robert McCoppin | Chicago Tribune): “Okay Cannabis is unlike any other business in the state, hosting licensed cannabis sales under the same roof with West Town Bakery, which serves beer, wine and liquor as well as bakery goods and other food.”

STRONG MAJORITIES OF TEXANS SUPPORT MEDICAL AND RECREATIONAL MARIJUANA LEGALIZATION, INCLUDING MOST REPUBLICANS, NEW POLL FINDS (Kyle Jaeger | Marijuana Moment): “Adult-use legalization similarly enjoys majority support regardless of party affiliation, with 80 percent of Democrats, 66 percent of independents and 55 percent of Republicans saying that favor the reform.”

International

🌎 CANNABIS PRODUCER TILRAY QUIETLY DROPS $4 BILLION SALES TARGET FOR 2024 (Matt Lamers | MJBiz): “The analyst said Tilray’s target was undone by “delayed” legalization in the United States and Germany plus ongoing issues in Canada, including price compression, overproduction and slowing national sales.”

🇲🇹 MALTA’S PIONEERING LEGAL CANNABIS CLUB FRAMEWORK ANNOUNCED, BUT CONCERNS RAISED LICENCE FEES COULD PUSH MANY TO BLACK MARKET (Ben Stevens | BusinessCann): “Andrew Bonello, President of pro-cannabis reform group ReLeaf Malta, said: “As an NGO founded on human rights and civil liberties, particularly for people who have been for decades incriminated for the sole crime of consuming or cultivating a plant, we continue to be very worried about developments related to cannabis associations in Malta.” ”

🇭🇰 HONG KONG TO BAN CBD, LABEL IT A ‘DANGEROUS DRUG’ (AP News): “Penalties include up to life in prison and Hong Kong $5 million ($638,000) in fines for importing, exporting or producing CBD. Possession of the substance can result in a sentence of up to seven years and Hong Kong $1 million ($128,000) in fines.”

WELCOME DISTRACTION

I…I don’t even know how to describe this one. So I’ll the folks at the A.V. Club do the talking:

Seinfeld has long inspired fan work, from the long-running @Seinfeld2000 Twitter account to video and audio remixes of every type. The only limiting factor in the endless production of these ideas is that they’re created by human beings who must eat, sleep, and use our fallible meat brains in order to think up and execute our Seinfeld-based projects.

No longer. Unconstrained by biology or good taste, an AI has been pumping out a seemingly infinite Seinfeld episode over on Twitch under the name Nothing, Forever.

Your first reaction will be “this is so stupid,” but good luck turning it off.

CAT OF THE WEEK

SPECIAL BULLETIN

I’m going to try my hand at livestreaming TODAY at 4:20PM Eastern. I’ll be recapping this week’s cannabis news and a whole lot more. You can watch it live or on-demand at YouTube, Twitch, or LinkedIn.

That’s a wrap on this issue. Thanks for reading! If you have any suggestions or feedback, email me here. Be sure to subscribe if you haven’t already, and if you would like to support my work, please consider a paid subscription.